-

-

- Financial Aid

- Financial Aid

- Scholarships

- Loans

- Grants

- Federal Work Study

- Additional Resources

-

A Taylor Education Is Worth the Investment—Now and for a Lifetime

A degree from Taylor University is more than preparation for a job. It's a launchpad for a meaningful life. The time, energy, and resources you invest now pay dividends far beyond graduation. Consider the numbers:We partner with you in this investment in your future. Review this important information regarding the costs to attend college at Taylor University, and reach out to us with any questions along the way.

$53,548: total direct costs for the fall and spring semesters

Total direct costs include:

Students enrolled full-time in either fall or spring can attend tuition free in January. This can save you up to $15,000 over four years.

The J-term program allows you to finish your degree faster or participate in unique global experiences.

$1,512 total J-term costs for on-campus students, including:

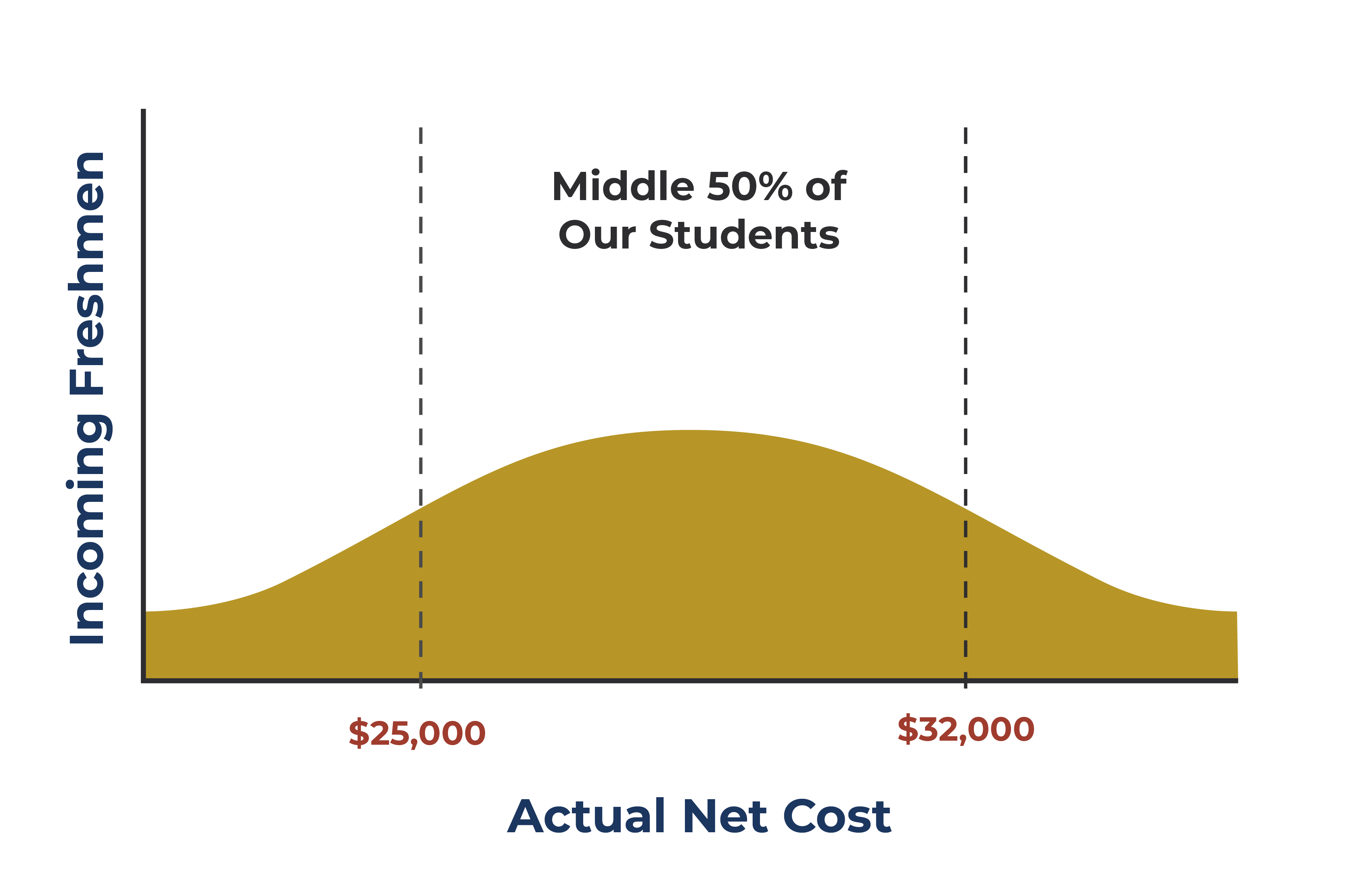

This graph shows our average net cost per year:

The graph visualizes the net cost most families pay through personal funding, outside scholarships, and loans for Taylor costs (tuition, fees, housing, food and J-term) after federal, state and institutional grants and scholarships have been applied.

The total cost to attend college includes tuition, fees, housing, food, and allowances for books, supplies, transportation and personal expenses.

The difference between your family’s resources, which is called the Student Aid Index (SAI), and the total cost of attending college determines your financial need. The SAI is determined by completing the Free Application for Federal Student Aid (FAFSA) each year.

The FAFSA considers the following factors when evaluating the family’s resources:

Education is an investment, and it can be affordable. Tayor financial aid resources fall into two categories: merit-based and need-based.

Working hard in high school can pay off! Our university scholarship awards are based on your test scores and GPA.

If you are interested in academic awards, you must have the required ACT, SAT, or CLT score and GPA to receive the amount listed. SAT score is calculated by combining the Math and Reading portions of the test.

These merit-based awards are renewable with a 3.0 college GPA and available to all incoming freshmen beginning in the fall of 2025. Decisions for merit-based aid are made independent of the FAFSA.

You may be eligible for need-based financial aid, depending on your financial need and other eligibility requirements. To find out your eligibility, you must file the Free Application for Federal Student Aid (FAFSA).

Need-based aid includes funding from:

All need-based amounts are subject to change based on federal regulations.

The scholarship priority filing deadline for the FAFSA is February 1 each year. The filing deadline for need-based grants from Taylor or the state of Indiana is April 15.

Education is an investment, and it can be affordable. Tayor financial aid resources fall into two categories: merit-based and need-based.

Working hard in high school can pay off! Our university scholarship awards are based on your test scores and GPA.

If you are interested in academic awards, you must have the required ACT, SAT, or CLT score and GPA to receive the amount listed. SAT score is calculated by combining the Math and Reading portions of the test.

These merit-based awards are renewable with a 3.0 college GPA and available to all incoming freshmen beginning in the fall of 2025. Decisions for merit-based aid are made independent of the FAFSA.

You may be eligible for need-based financial aid, depending on your financial need and other eligibility requirements. To find out your eligibility, you must file the Free Application for Federal Student Aid (FAFSA).

Need-based aid includes funding from:

All need-based amounts are subject to change based on federal regulations.

The scholarship priority filing deadline for the FAFSA is February 1 each year. The filing deadline for need-based grants from Taylor or the state of Indiana is April 15.

| Scholarship | Amount | GPA | SAT/ACT/CLT |

|---|---|---|---|

| President* | $21,000 ($84,000 over 4 years) | 3.70+ | 1430/32/103 |

| Dean* | $19,000 ($76,000 over 4 years) | 3.70+ | 1270/27/90 |

| Faculty* | $17,000 ($68,000 over 4 years) | 3.70+ | —No Scores Required— |

| Trustee | $15,000 ($60,000 over 4 years) | 3.30-3.69 | —No Scores Required— |

| Director | $11,000 ($44,000 over 4 years) | 3.29 & below | —No Scores Required— |

*Students must maintain a 3.0 GPA at Taylor to retain the President, Dean, and Faculty scholarships, otherwise the scholarship drops to the Trustee Scholarship level.

Scholarship amounts are for new freshman students entering during the 2025-26 academic year. Test scores must be received by April 1 for merit scholarship consideration. A significant portion of Taylor’s scholarships are based on academic merit and demonstrated need.

Fall 2024 incoming student profile:

Once you complete your admissions application and are accepted to Taylor, here are the important dates to keep in mind regarding financial aid.

File the FAFSA as soon as possible after October 1. Start by creating your FSA ID. The FSA ID confirms your identity on the FAFSA and related documents. Students and parents must create their own FSA IDs.

Once you have your FSA ID, login in to Federal Student Aid with your FSA ID. Use code 001838 to indicate that you want a copy of your FAFSA sent to Taylor University.

If you need help filing your FAFSA, connect with the Financial Aid Team at 765-998-5358 or [email protected].

Financial aid is processed on a rolling basis after December 1 once we have received the FAFSA and any other required documents. If additional information is needed, you’ll be notified via email and can find the requests under the “Documents & Messages" section in MYFA (My Financial Aid Online site).

February 1 is the priority FAFSA filing deadline for Taylor endowed scholarships consideration.

April 15 is the FAFSA filing deadline for grants from the State of Indiana and the priority filing deadline for need-based grants from Taylor.

Accept or decline your student loans by June 15 through MyFA to ensure your loan(s) appear on your account when the bill is sent in July.

Notify the financial aid office of any outside or private scholarships, grants, or loans you receive by July 1. Statements are sent out on July 10.

Financial Aid Office

Taylor University

1846 Main Street

Upland, Indiana 46989-1001

Feel free to stop by our office in the lower level of Zondervan Library.

Phone (Toll Free): 1-800-882-3456

Phone: 765-998-5358

Fax: 765-998-4910

[email protected]