-

-

- Financial Aid

- Financial Aid

- Scholarships

- Loans

- Grants

- Federal Work Study

- Additional Resources

-

It's an investment that builds in value long after you graduate. Our programs will prepare you for your chosen career—and so much more.

Your commitment of time, potential, and resources is worth the cost when you consider the numbers:

We partner with you in this investment in your future. Review this important information regarding the costs to attend college at Taylor University, and reach out to us with any questions along the way.

$51,918: total direct costs for the fall and spring semesters

Total direct costs include:

Students enrolled full-time in either fall or spring can attend tuition free in January. This can save you up to $15,000 over four years.

The J-term program allows you to finish your degree faster or participate in unique global experiences.

$1,457 total J-term costs for on-campus students, including:

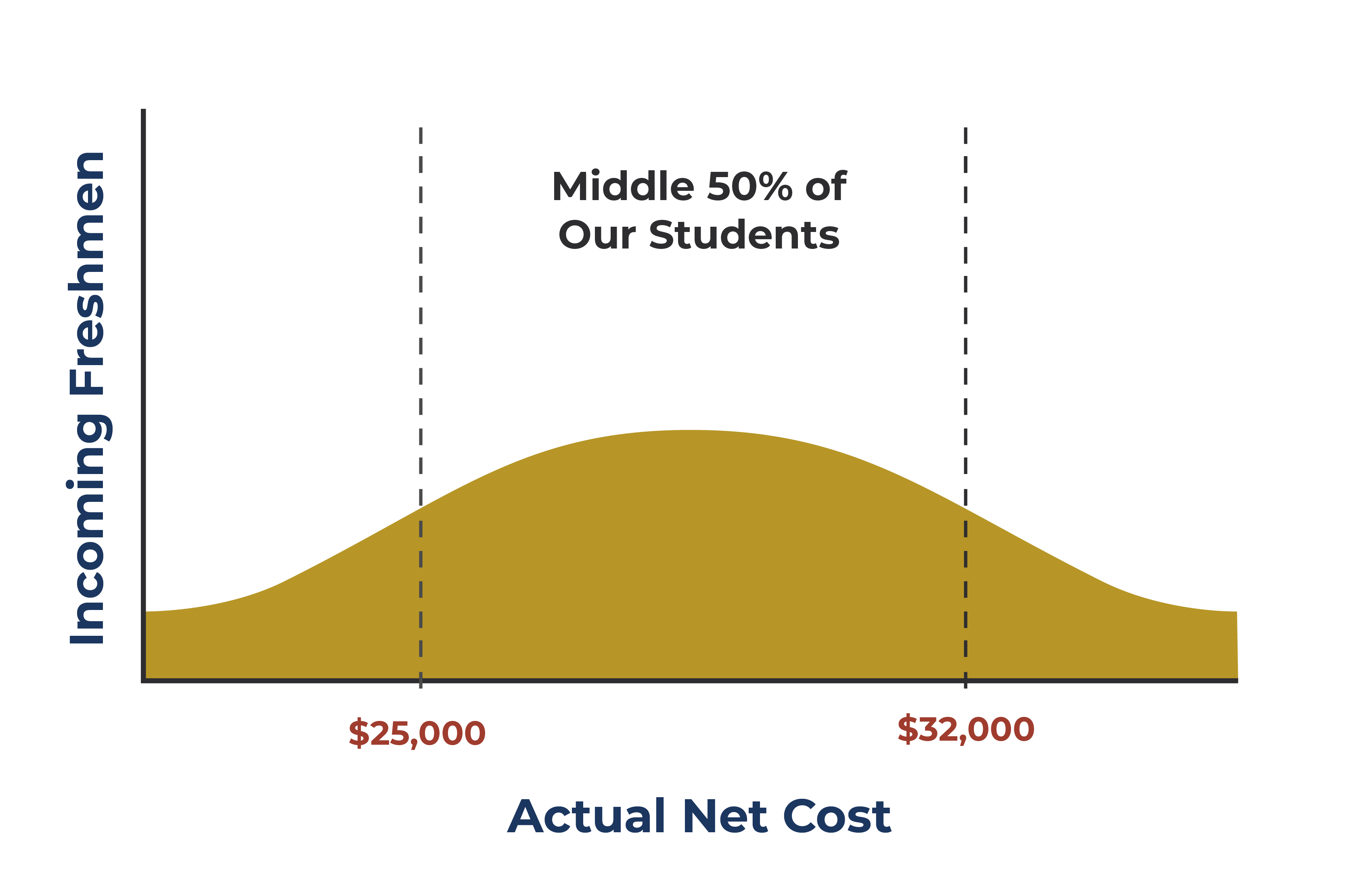

This graph shows our average net cost per year:

The graph visualizes the net cost most families pay through personal funding, outside scholarships, and loans for Taylor costs (tuition, fees, housing, food and J-term) after federal, state and institutional grants and scholarships have been applied.

The total cost to attend college includes tuition, fees, housing, food, and allowances for books, supplies, transportation and personal expenses.

The difference between your family’s resources, which is called the Student Aid Index (SAI), and the total cost of attending college determines your financial need. The SAI is determined by completing the Free Application for Federal Student Aid (FAFSA) each year.

The FAFSA considers the following factors when evaluating the family’s resources:

Education is an investment, and it can be affordable. Tayor financial aid resources fall into two categories: merit-based and need-based.

Working hard in high school can pay off! Our university scholarship awards are based on your test scores and GPA.

If you are interested in academic awards, you must have the required ACT, SAT, or CLT score and GPA to receive the amount listed. SAT score is calculated by combining the Math and Reading portions of the test.

These merit-based awards are renewable with a 3.0 college GPA and available to all incoming freshmen beginning in the fall of 2024. Decisions for merit-based aid are made independent of the FAFSA.

You may be eligible for need-based financial aid, depending on your financial need and other eligibility requirements. To find out your eligibility, you must file the Free Application for Federal Student Aid (FAFSA).

Need-based aid includes funding from:

All need-based amounts are subject to change based on federal regulations.

The scholarship priority filing deadline for the FAFSA is February 1 each year. The filing deadline for need-based grants from Taylor or the state of Indiana is April 15.

Education is an investment, and it can be affordable. Tayor financial aid resources fall into two categories: merit-based and need-based.

Working hard in high school can pay off! Our university scholarship awards are based on your test scores and GPA.

If you are interested in academic awards, you must have the required ACT, SAT, or CLT score and GPA to receive the amount listed. SAT score is calculated by combining the Math and Reading portions of the test.

These merit-based awards are renewable with a 3.0 college GPA and available to all incoming freshmen beginning in the fall of 2024. Decisions for merit-based aid are made independent of the FAFSA.

You may be eligible for need-based financial aid, depending on your financial need and other eligibility requirements. To find out your eligibility, you must file the Free Application for Federal Student Aid (FAFSA).

Need-based aid includes funding from:

All need-based amounts are subject to change based on federal regulations.

The scholarship priority filing deadline for the FAFSA is February 1 each year. The filing deadline for need-based grants from Taylor or the state of Indiana is April 15.

| Scholarship | Amount | GPA | SAT | ACT | CLT |

|---|---|---|---|---|---|

| President* | $21,000 | 3.70+ | 1430 | 32 | 103 |

| Dean* | $19,000 | 3.70+ | 1270 | 27 | 90 |

| Faculty* | $17,000 | 3.70+ | —No Scores Required— | ||

| Trustee | $15,000 | 3.30-3.69 | —No Scores Required— | ||

| Director | $11,000 | 3.29 & below | —No Scores Required— | ||

*Students must maintain a 3.0 GPA at Taylor to retain the President, Dean, and Faculty scholarships, otherwise the scholarship drops to the Trustee Scholarship level.

Scholarship amounts are for new freshman students entering during the 2025-26 academic year. Test scores must be received by April 1 for merit scholarship consideration. A significant portion of Taylor’s scholarships are based on academic merit and demonstrated need.

Fall 2024 incoming student profile:

To receive need-based aid, you must file the FAFSA.

Financial aid packages will not be awarded until you are accepted to Taylor. However, you may begin the financial aid process before your acceptance is finalized.

The FSA ID confirms your identity on the FAFSA and related documents. Students and parents must create their own FSA IDs.

File the FAFSA as soon as possible after October 1:

Be sure to indicate that you want a copy of your FAFSA sent to Taylor University (code: 001838).

If you need help filing your FAFSA, connect with the Financial Aid Team at 765-998-5358 or finaid@taylor.edu.

Important deadlines:

After November 1, begin checking your financial aid status under the “Your Documents” tab in MYFA (My Financial Aid Online site).

Apply for loans beginning May 15 through MYFA. To ensure that your loan(s) appear on your account when the bill is sent, we recommend that you complete the loan process by July 1.

Notify our financial aid office of any outside or private scholarships, grants, or loans you receive.

Financial aid packages are processed on a rolling basis beginning on November 1. You should receive their package within four weeks of submitting all required documents. Reach out to us with questions.

Financial Aid Office

Taylor University

1846 Main Street

Upland, Indiana 46989-1001

Feel free to stop by our office in the Freimuth Administration Building.

Phone (Toll Free): 1-800-882-3456

Phone: 765-998-5358

Fax: 765-998-4910

Email